Ethereum Price Prediction: September Outlook Bullish Despite Temporary Pressures

#ETH

- ETH testing critical support at $4,400 with Bollinger Band analysis suggesting potential rebound

- Strong fundamental drivers including $200B Base volume and ETF inflows supporting bullish outlook

- Short-term validator sell pressure of $5B creating temporary weakness amid whale accumulation

ETH Price Prediction

Technical Analysis: ETH at Critical Support Level

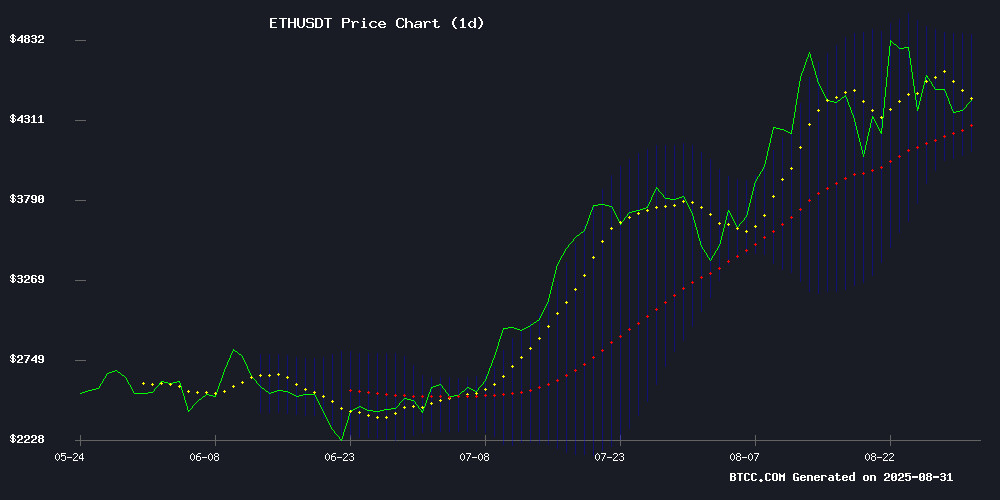

ETH is currently trading at $4,460.27, slightly below its 20-day moving average of $4,487.50, indicating potential short-term weakness. The MACD reading of -14.59 shows bearish momentum, though the histogram at 125.33 suggests some buying pressure may be emerging. Bollinger Bands position ETH NEAR the middle band, with support at $4,106.37 and resistance at $4,868.63. According to BTCC financial analyst Sophia, 'The current technical setup suggests ETH is testing crucial support levels. A hold above $4,400 could pave the way for a retest of the $4,800 resistance zone in September.'

Market Sentiment: Bullish Fundamentals Amid Short-Term Pressure

Positive developments including Base surpassing $200 billion in Uniswap volume and strong ethereum ETF inflows are creating constructive underlying momentum. However, the market faces headwinds from a record validator exodus creating $5 billion in potential sell pressure. BTCC financial analyst Sophia notes, 'While short-term selling pressure from validators is concerning, whale accumulation patterns and reduced profit-taking suggest this dip may be temporary. The fundamental adoption story remains intact with institutional inflows and DeFi growth supporting longer-term appreciation.'

Factors Influencing ETH's Price

Base Surpasses $200 Billion Trade Volume on Uniswap, Cementing Its Position in DeFi

Base, Coinbase's Layer 2 blockchain, has eclipsed $200 billion in trade volume on Uniswap, doubling its previous $100 billion milestone in a matter of months. This rapid ascent underscores Base's emergence as a dominant force in scaling Ethereum's decentralized finance ecosystem, trailing only Arbitrum in Layer 2 adoption.

The platform's unique appeal bridges institutional and retail investors, leveraging Coinbase's credibility to amass $3.08 billion in Total Value Locked. Unlike competitors focused primarily on crypto-native users, Base attracts traditional finance players through regulated infrastructure and DEEP liquidity pools.

Ethereum ETF Inflows Drive Strong August Performance, September Outlook Bullish

Ethereum surged 17.5% in August, fueled by record ETF inflows nearing $4 billion for the month. Institutional adoption accelerates as VanEck's Jan van Eck brands ETH "the Wall Street token," highlighting its growing dominance in traditional finance.

Whale activity signals confidence, with nine major investors accumulating $450 billion worth of ETH last month. The cryptocurrency now eyes potential all-time highs in September as ETF momentum and institutional demand converge.

Ethereum Price Analysis: Critical Juncture Could Define ETH’s Bull Market Status

Ether remains in a corrective phase after failing to sustain momentum above its all-time high NEAR $4,900. The second-largest cryptocurrency now tests crucial support at $4,200, a level that will determine whether the asset maintains its bullish trajectory or faces deeper retracement.

Technical indicators show weakening momentum, with the daily RSI cooling to 52. A decisive break below $4,200 could trigger a slide toward $3,800, where prior consolidation and liquidity pools reside. Conversely, holding this support may set the stage for another attempt at the $4,800 resistance zone.

The 4-hour chart reveals a broken ascending trendline, though the broader channel's midline continues to provide support. ethereum now oscillates between $4,200 and $4,800, with market participants awaiting a clear directional signal.

Ethereum Faces $5 Billion Sell Pressure as Validator Exodus Hits Record High

Ethereum confronts unprecedented supply pressure as over 1 million ETH—worth approximately $5 billion—queues for withdrawal from staking contracts. Blockchain analytics reveal validator exits have surged to an 18-day backlog, the longest delay since the network's transition to proof-of-stake.

ValidatorQueue data shows simultaneous growth in both entry and exit queues, creating a net staking increase of 200,000 ETH last week. Etherscan recorded withdrawals spiking from 916,000 ETH to over 1 million within two weeks, while new deposits climbed from 150,000 to 580,000 ETH during the same period.

This capital rotation emerges alongside Ethereum's price rally, sparking debate among analysts. Some interpret the movement as profit-taking after recent gains, while others see strategic portfolio rebalancing within the ecosystem. The network's resilience will be tested as it processes its largest validator turnover to date.

Ethereum Dip May Be Temporary Amid Whale Accumulation and Easing Profit Taking

Ethereum's recent price decline appears shallow as on-chain data reveals whales accumulating nearly $1 billion worth of ETH over two days. The Spent Coins Age Band metric has plunged 74% from August highs, signaling reduced selling pressure from long-term holders.

Historical patterns suggest such conditions often precede rallies. In July, similar on-chain dynamics preceded a 52% surge, while an August repeat fueled a 20% climb. Addresses holding 10,000+ ETH have increased their holdings from 95.76 million to 96 million ETH since August 27.

The market structure now mirrors previous inflection points where suppressed profit-taking and whale accumulation created launchpads for upward momentum. With spent coins at monthly lows, the current dip may represent accumulation territory rather than sustained downside.

Ethereum Foundation Pauses Open Grant Applications to Shift Funding Strategy

The Ethereum Foundation has temporarily halted new grant applications under its Ecosystem Support Program (ESP), signaling a strategic pivot toward proactive funding. The decision, announced on August 29, aims to address capacity constraints caused by high application volume, which limited the program's ability to prioritize emerging initiatives.

ESP awarded $3 million to 105 projects in 2024 alone, including Commit-Boost and Web3Bridge, spanning infrastructure, education, and community development. Existing grantees will retain support, with Office Hours remaining available for feedback. The redesign focuses on targeted funding aligned with Ethereum's evolving priorities.

Ethereum Liquidity Pools Signal Buy-the-Dip Setup as ETH Drops to $4.3K

Ethereum's price action reveals compelling liquidity dynamics as ETH tests the $4,300 level. Order book heatmaps indicate concentrated buy orders between $3,800 and $4,200, forming a robust support zone that could absorb selling pressure. Market participants appear poised to accumulate at these levels, with analyst Ted Pillows noting "liquidity is laying to the downside" and preparing to buy the dip.

Above current prices, a massive $5 billion short liquidation cluster looms near the $5,000 threshold. Exchange data shows particularly dense liquidation zones on Binance ($14M), OKX ($10.81M), and Bybit ($13.54M). This creates potential for a violent short squeeze should ETH regain upward momentum, with some traders warning of catastrophic liquidations for overleveraged positions.

The technical setup shows ETH forming a bullish pennant pattern, suggesting consolidation before potential continuation. A decisive break above $4,600 WOULD confirm the pattern and open a clear path to test the critical $5,000 resistance level where shorts remain vulnerable.

Ethereum-Based Meme Coin BullZilla Launches Presale with Dynamic Pricing and Deflationary Mechanisms

BullZilla ($BZIL), a new Ethereum-based meme coin, has entered its presale phase with a narrative-driven launch strategy. The project's Progressive Price Engine adjusts token pricing dynamically—increasing either every $100,000 raised or every 48 hours—creating a forward-moving valuation curve.

The tokenomics feature a 160 billion supply cap, with 50% allocated to presale, 20% to staking rewards, and 20% to treasury reserves. A unique Roar Burn Mechanism systematically reduces circulating supply, mirroring deflationary models seen in other blockchain projects.

Market observers note the project's attempt to differentiate itself within the crowded meme coin space through structured tokenomics. However, the long-term viability of such mechanisms remains untested in volatile crypto markets.

SharpLink Co-CEO Joseph Chalom on Ethereum Treasury Strategy and Future of Tokenization

Joseph Chalom, former BlackRock executive and now co-CEO of SharpLink Gaming Inc., has drawn parallels to MicroStrategy for his aggressive Ethereum treasury strategy. In an exclusive interview, Chalom detailed his transition from traditional finance to leading a Nasdaq-listed company betting big on ETH.

Chalom spent two decades at BlackRock, scaling its Aladdin risk management system and later spearheading its digital asset team. His work focused on bridging institutional investors with crypto markets—a shift he views as inevitable. After retiring in June 2025, Chalom was persuaded to join SharpLink following discussions with Ethereum co-founder Joseph Lubin, now chairman of SharpLink's board.

"We share a vision of more efficient systems for value exchange," Chalom said, highlighting Ethereum's potential to revolutionize transaction settlement. SharpLink's treasury strategy mirrors MicroStrategy's Bitcoin accumulation, but with a focus on ETH as the backbone of tokenization and decentralized finance.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH could reach $4,800-$5,200 by end of September if it maintains support above $4,400. The combination of strong ETF inflows, Base ecosystem growth, and whale accumulation patterns suggests the current dip represents a buying opportunity rather than a trend reversal.

| Timeframe | Target Price | Key Drivers |

|---|---|---|

| Short-term (2 weeks) | $4,600-$4,800 | ETF inflows, Bollinger Band resistance |

| Mid-term (1 month) | $4,800-$5,200 | Validator pressure easing, institutional adoption |

| Long-term (3 months) | $5,500+ | DeFi growth, tokenization developments |